Crypto tax software for UK investors

Recap is the only crypto tax calculator built in the UK and backed by UK crypto tax professionals. Track your entire crypto portfolio in one place and take control of your crypto taxes.

Explore why Recap is the trusted choice for crypto investors and crypto tax professionals

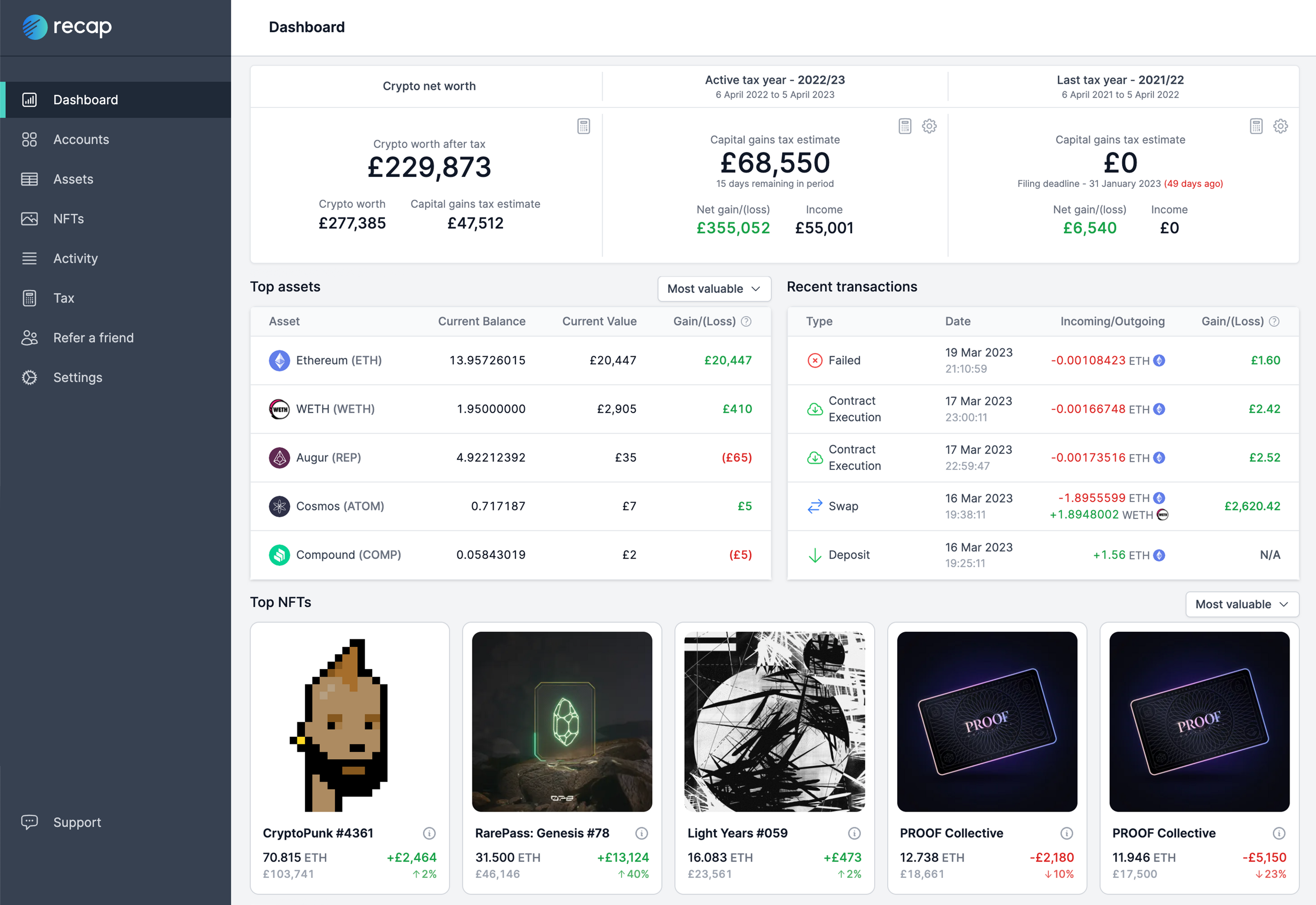

CRYPTO PORTFOLIO TRACKER

Track your entire crypto portfolio in one place

Recap is more than just crypto tax software. See the true value of your crypto portfolio with real-time tracking of your crypto investments.

One view of all your crypto accounts

Track all of your historical cryptocurrency transactions and crypto assets

See your entire crypto worth in pounds

Analyse the performance of your crypto to plan and optimise future investments

CRYPTO TAX SOFTWARE

Automatically calculate your crypto tax report

Simply import your crypto trading history and Recap instantly calculates your capital gains and income taxes.

Compliant with the latest HMRC guidance, bed and breakfast and share pooling rules

Preview your capital gains for free to understand if you need to file

Generate a tax report with everything needed to fill in your SA108 and complete your tax return

Securely share your data with your accountant and delegate filing

HOW IT WORKS

Crypto tax made simple

Recap makes it easy to calculate and stay on top of your crypto taxes.

- 1

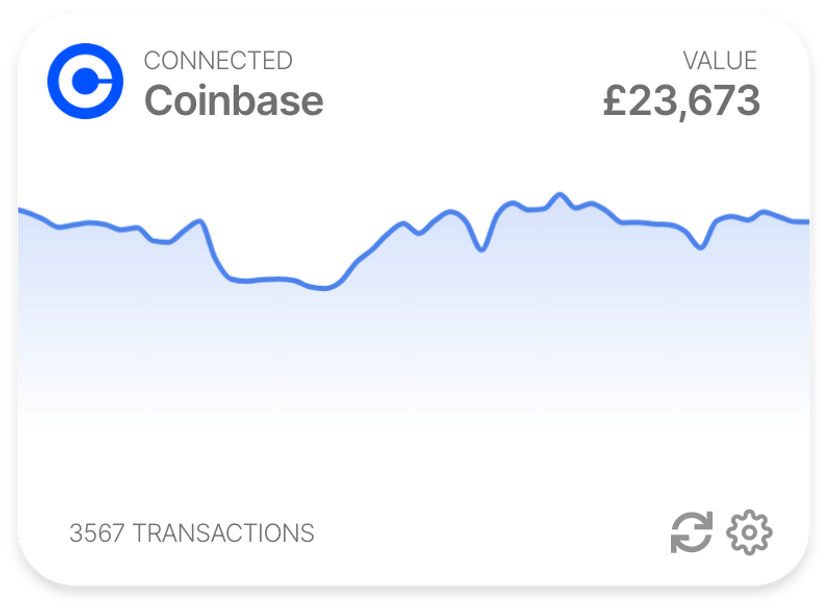

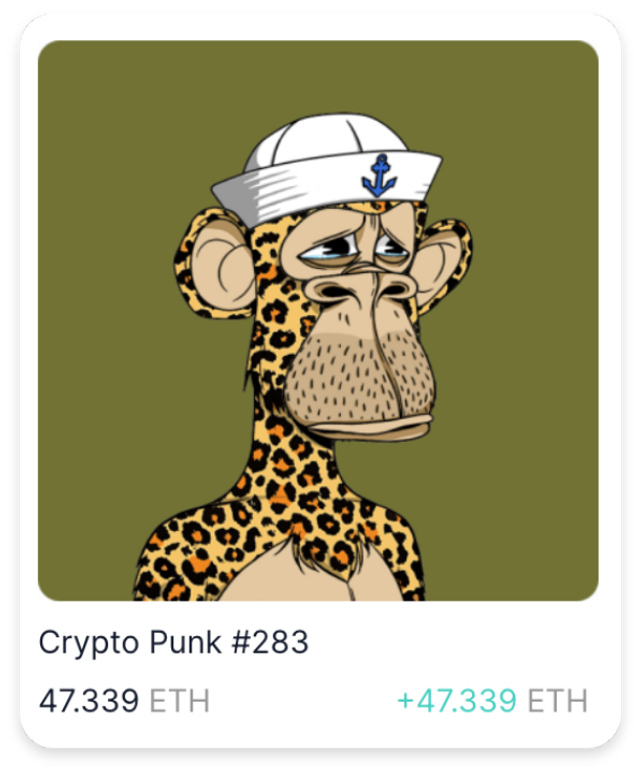

Import your transactions and calculate your crypto taxes with ease whether your trading, earning DeFi rewards or collecting NFTs!

Real-time API sync for major exchanges like Coinbase, Kraken and Binance

On-chain support for Ethereum, Binance Smart Chain and Polygon wallets

CSV import for all other accounts

- 2

- 3

RESOURCE LIBRARY

UK crypto tax guides

Browse our guides to demystify the complexities of UK crypto tax without the confusing jargon.

FAQs